Key Highlights :

- US PPI released which indicates inflation easing down to 2.6% well below the expected forecast.

- Softer inflation boosts odds of a 50bps Fed rate cut in September.

- Crypto markets have gained as investors expect renewed liquidity flows.

The latest U.S. inflation data gave financial markets and crypto investors a positive signal. The Producer Price Index, which measures the average change in prices that producers receive for goods and services, rose only 2.6% in August. Analysts had expected a 3.3% rise, so there is a difference of 0.7% that indicates that the inflation at the wholesale level is slowing more than anticipated. Slower PPI growth indicates that overall price pressures in the economy may be easing, which could eventually benefit consumers and markets alike.

For the traditional markets and crypto, this number matters a lot. Cooling inflation will improve the chances of the Federal Reserve cutting the interest rates sooner and by a huge margin than what was expected before, possibly even by 50 basis points (0.50%) at its upcoming September policy meeting.

Why Inflation Matters for Crypto Investors?

At the first glance, someone who is new to the finance world may wonder: what does inflation have to do with Bitcoin or Ethereum? Let’s quickly break it down for a better understanding.

When the inflation is high, the Fed keeps interest rates high which slows down the economy. High rates make borrowing expensive and reduces business spending, and it even pushes investors to keep money in safe government bonds rather than keeping it in riskier assets such as stocks or crypto.

But when inflation cools, things flip. The Fed can lower the interest rates which helps the citizens in two ways:

There businesses and individuals can access credit more easily, which leads to more growth, investment and spending. In short there is cheaper borrowing.

As the rates fall down, it encourages investors to move their money into assets that are riskier that provide high returns. These assets include tech stocks and cryptocurrencies.

This is why Bitcoin, Ethereum and other altcoins usually move higher when inflation data comes in softer than expected. Investors start to price in easier monetary conditions and rush back into assets that can potentially outperform.

Immediate Market Reaction

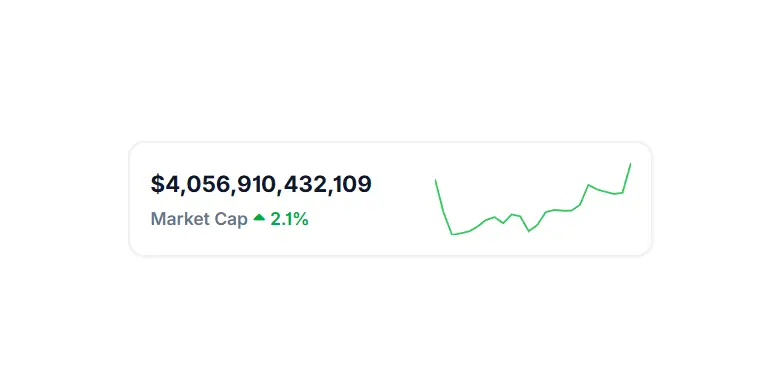

The PPI surprise did not just lift the Wall Street sentiment but also managed to boost the crypto industry. The global cryptocurrency market capitalization climbed 2.1% and crossed the $4 trillion mark once again as per CoinGecko. These numbers indicate that there is an inflow of money into the digital assets.

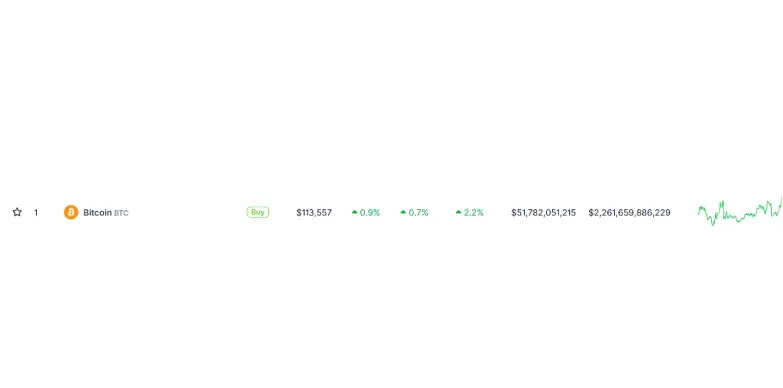

Bitcoin also rose by 0.7% and reclaimed the $113,000 level, a psychologically important level that traders have been watching closely for a while now. Ethereum also experienced an uptick along with the broader altcoin market. In fact, all of the major cryptocurrencies turned green after the inflation release. These numbers indicate that optimism is spreading across the entire sector, not just Bitcoin.

How This Helps Crypto in Simple Terms

Think of the economy like a tap that is controlling how much money flows into the markets. When the inflation is high, the Federal Reserve tightens the tap which slows down the flow of money and the system does not overheat. But when the inflation cools down, the Fed can open the tap wider, letting more money move through the economy.

That extra money does not go into safe assets like bonds, but it often finds its way into riskier assets such as cryptocurrencies. When investors believe money is cheaper and easier to access, they become more willing to put funds into Bitcoin, Ethereum and other digital assets.

So, to put it out there in simple terms: lower inflation means cheaper money, which often boosts crypto markets.

The Road Ahead

The crypto received a boost from today’s inflation data but the real test is the Fed’s September meeting. If the rate cut is big, it could signal the start of easier money policies, which usually helps Bitcoin and other digital assets. Still risks like rising oil prices or supply chain problems could bring inflation back, analysts hence remain cautious.

Also Read: SEC Crypto Task Force to Host Financial Privacy Roundtable