Key Highlights:

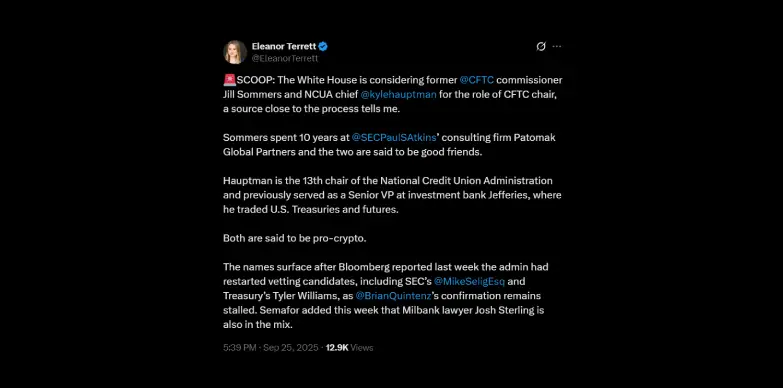

- The White House has added two more names for the role of CFTC Chair.

- Jill Sommers and Kyle Hauptman, both of them are said to have pro-crypto stance.

- This move has delayed the confirmation of the current nominee Brian Quintenz.

The White House is said to be considering former CFTC commissioner Jill Sommers and current NCUA chair Kyle Hauptman as its possible picks for the next Commodity Futures Trading Commission (CFTC) chair. The search is being conducted while the community grows annoyed day-by-day over the Senate’s tardiness in approving Brian Quintenz, who is said to be President Trump’s first nominee.

Jill Sommers: Regulatory Expertise Backed by Industry Insight

Jill Sommers previously has served as a Commissioner at the CFTC for several years and since has spent the past decade at Patomak Global Partners, which is a regulatory consulting firm founded by Paul Atkins. Sommers is well-regarded for her strong professional ties with Atkins and her deep knowledge of derivative markets and regulations.

The former commissioner is also renowned for encouraging innovation, which includes having a favourable opinion of cryptocurrency, which many believe will become more significant as long as the CFTC continues to regulate the growth of digital assets.

Kyle Hauptman: A Blend of Market Experience and Regulation

Kyle Hauptman is the current chair of the NCUA, where he looks after federal credit unions across the U.S. Before his government role, he worked as a Senior Vice President at Jefferies, handling U.S. Treasury and futures trading. His career combines hands-on market expertise with regulatory leadership.

Similar to Sommers, Hauptman is also viewed as a crypto-friendly candidate, a trait that is being considered important as the CFTC adapts to the fast-changing world of crypto derivatives and digital asset oversight.

Expanded Candidate Pool Reflects Regulatory Complexity

There are few more names that are also present in the mix. Other names include Michael Selig, a member of the SEC’s crypto task force, and Tyler Williams, a Treasury official who helped draft the White House’s digital finance report. Josh Sterling, a Milbank partner and former CFTC official is also said to be considered.

With such a long range of candidates, it is clear that the White House understand the responsibilities and duties that are waiting for the CFTC chair. It is also necessary to understand that the chair has to look after derivatives with new responsibilities in growing areas that include spot crypto market.

Political Headwinds Delay Brian Quintenz’s Confirmation

Brian Quintenz, President Trump’s nominee for CFTC chair, is facing long delays in Senate confirmation, partly due to pushback from key crypto industry leaders like the Winklevoss twins. The Gemini founders have openly criticized his regulatory stance and this indicates a divide between the administration’s choice and industry voices calling for a more innovation-friendly approach. This resistance has slowed the process, and is leaving the CFTC without a confirmed chair for several months.

Critical Role of the CFTC Chair

The CFTC chair guides the agency’s strategy and policy, this role is now more critical as Congress considers giving it oversight of spot crypto trading in Bitcoin and Ethereum. Concerns about continued delays and how they might harm regulation and stability in the cryptocurrency market are raised by the commission’s limited ability to push reforms with only acting leadership in place.

Implications for Crypto Regulation and Market Innovation

Appointing Sommers or Hauptman could indicate a shift towards balancing innovation along with the oversight. Both of these candidates are seen as pro-crypto candidates and may shape rules that increase adoption along with protecting the investors. A confirmed chair would provide direction, speed up the key rulemaking process, will guide U.S. financial policy and will shape the future of crypto.

Also Read: Kraken Donates $1M to Pro-Crypto PAC to Defend Digital Rights