Key Highlights:

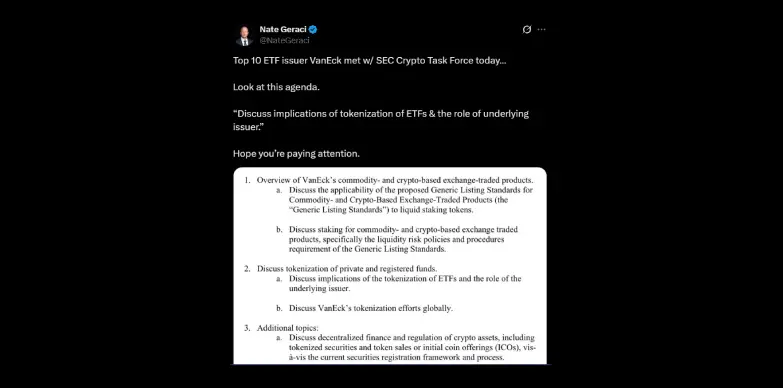

- Nate Geraci highlights VanEck’s SEC meeting that focused on ETF tokenization.

- Talks with institutions point to big regulatory steps for crypto ETFs, staking tokens, and digital asset security.

- The agenda’s scope suggests global implications for regulatory compliance, investor protection and mainstream ETF market growth.

On September 25, 2025, VanEck, a well-known global ETF issuer, met with the SEC Crypto Task Force to discuss a key plan that is focused on the future of regulated crypto and commodity funds. The meeting, which was highlighted by Nate Geraci, president of The ETF Store and a well-known industry leader, echoed both across the Wall Street and the digital asset market.

The agenda that has been shared by the president of The ETF Store on X (formerly known as Twitter), indicates that it goes beyond the routine compliance. The firm asked regulators to review broad listing rules for new crypto ETPs, bringing up important questions on whether future ETFs could add liquid staking tokens and other blockchain assets.

They also urged the regulators to address how staking in commodity and crypto exchange-traded products should manage liquidity risks, something that has quickly become a compliance hotspot as staking, derivatives, and yield strategies move from DeFi to exchanges and brokerage.

Nate Geraci’s Take: Industry Spotlight

Geraci has often highlighted major regulatory talks. He called this meeting a turning point, tweeting: “Hope you are paying attention”, a sign that the ETF and the crypto sectors may be close to a big change.

For Geraci and other industry leaders, this direct talk of tokenized ETFs with the SEC official indicates a shift that is taking place in the rulemaking policy. Recent events such as the “Tokenization: Moving Assets Onchain” set the early groundwork.

VanEck and its clear agenda point (from liquid staking risks to tokenized fund filings) push these ideas forward, indicating and proving that leading firms are not just waiting, they are shaping policy talks and giving regulators live market data, tech demos, and custody options to review.

What’s at Stake? The Huge Potential

The impact of this meeting will go well beyond one company. If the SEC agrees with VanEck’s plans, the ETF market could see changes as follows:

- Tokenized ETFs Go Mainstream: Blockchain-based ETF structures might become the new normal and offer programmable compliance, greater transparency, and instant settlements.

- Enhanced Investors Access and Security: From MPC(Multi-Party Computation)-based digital tools to worldwide interoperability, regulators could allow a new era of investor safeguards and broader market access.

- DeFi Crossover: Key issues such as DeFi compliance and tokenized securities show that rules are starting to match innovation, opening the door for U.S.-listed DeFi and stablecoin investment products.

- Institutional and Retail Participation: As made obvious by Geraci, easier access, better reporting and stronger risk control can lead to a huge flow of capital.

Global, Regulatory and Tech Impact

VanEck’s global growth, which was noted in the meeting, is set to shape ETF launches in Europe, Asia, and North America. Many rivals and overseas regulators are now focused on every action that SEC makes and ready to adopt proven custody, compliance, or risk models.

The talk also made digital asset custody a main focus which includes MPC tech now cited in possible custody rule updates, showing how fund security and transparency can improve for the next-gen ETFs.

All Eyes on the SEC

This meeting which was brought to light by Nate Geraci, could be a big turning point for both rules and technology in ETFs. As steps are being taken to make on-chain fund compliance real, both experts and everyday investors should pay significant attention as the future of fund investing might be shaping up now. Early market reactions are positive as spot crypto ETFs are seeing record inflow day-by-day, and big institutions are showing a strong interest in these ideas, tokenized ETFs and DeFi-based investment products may become much more common in the coming future.