Key Highlights:

- U.S. national debt is rapidly approaching $38 trillion.

- Ongoing federal government shutdown has brewed a sense of economic uncertainty.

- Bitcoin (BTC) is now being seen as an inflation hedge amid turmoil.

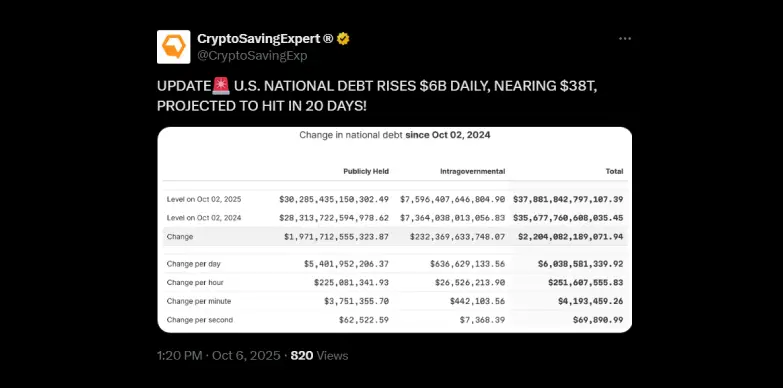

The U.S. national debt is increasing day-by-day. Currently it is increasing by about $6 billion daily and rapidly approaching the $38 trillion mark which is being projected to reach the said mark within the next 20 days. With this level of debt, it poses significant challenges to economic stability, inflation control, and fiscal responsibility. The US government has shut down due to disagreements about money. This has made people worried about the economy and unsure about traditional money systems. As a result of this, many are turning to Bitcoin as a safe and reliable option as Bitcoin is seen as a hedge against inflation and as a stable store of value.

The Escalating U.S. National Debt Crisis

With the second quarter of 2025, the U.S. national debt stands approximately at $37.8 trillion, which is a significantly high figure that now represents 119% of the country’s Gross Domestic Product (GDP). It is being predicted that the U.S. government debt might reach $52 trillion by 2035, if there are no changes in the spending or taxations. The number is huge and it will be a big problem because it directly means that the country’s finances may not be sustainable in the long run.

Interest on this debt takes up a growing share of government spend, which is over 13% in 2024. This leaves lesser room to fund other priorities. The debt is owned by private investors, foreign governments, and public trust funds, with foreign holders making up a large portion, which adds an international dimension to its effects.

The October 2025 Government Shutdown and its Ripple Effects

This national debt crisis suffers more because of the federal government shutdown that started on October 1, 2025. This shutdown has been imposed because Congress failed to pass funding bills, about 800,000 federal workers are furloughed, and another 700,000 are working without pay. Then there are the essential services such as Social Security, Medicare and transportation continue to operate, but many agencies are partially or fully closed. This shutdown has has disrupted daily life and has shaken the confidence in the government.

Bitcoin’s Rising Role as an Inflation Hedge and Safe Haven

In this context, Bitcoin’s role as “digital gold” has become more and more prominent. Bitcoin has a fixed supply of 21 million coins, which prevents inflation from oversupply. This feature makes BTC appealing to the investors that are looking to purchasing power amid rising monetary inflation and growing fiscal deficits.

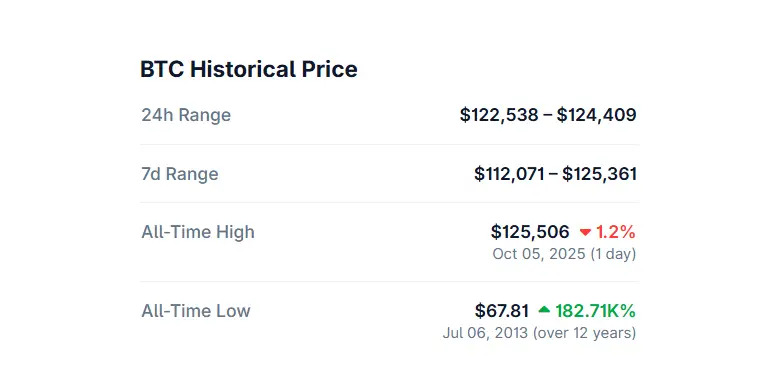

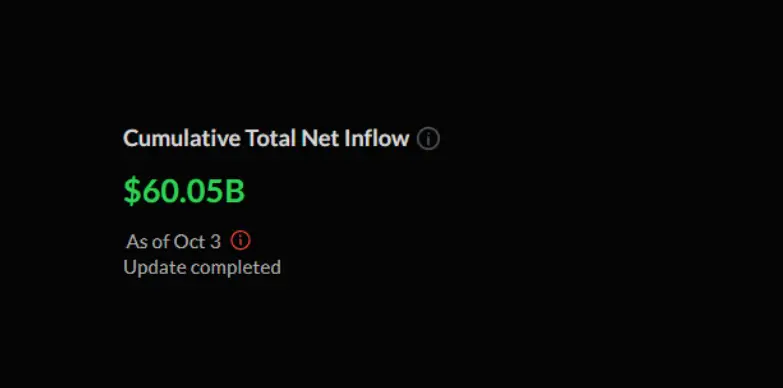

This year, Bitcoin’s price has increased significantly. Yesterday, October 5, 2025, the price of the token hit the $125,000 mark and BTC ETFs (ETFs are investment vehicles that allow both retail and institutional investors to invest in crypto without having to hold them directly) have also seen over $60 billion in inflows so far this year. These two figures indicate that the investor interest in BTC is growing day-by-day. This increasing popularity drives demand and the price then also increases, solidifying BTC’s potential as a reliable hedge against inflation.

Limitations: Why Bitcoin Isn’t a Cure-All

Even though Bitcoin is considered as a hedge against inflation and its use is growing, it cannot solve America’s debt and shutdown problems by itself. The political gridlock and deep fiscal imbalances behind crises need complex policy actions that Bitcoin alone cannot deliver. The size of the U.S. debt far exceeds Bitcoin’s market value, which limits its ability to cover national obligations.

Moreover, Bitcoin is an asset that is volatile. It is highly influenced by regulations and market sentiment, and because of this reasons, it becomes unsuitable stable tool for national reserves or debt repayment. True fiscal stability requires legislative reforms that reduce deficits, control spending and encourage economic growth, with Bitcoin playing supportive and not replacement roles.

It is clear that Bitcoin alone cannot solve the U.S. debt or the government shutdown, but its fixed supply and growing use make it a safe option for protecting money. As the economy and government face uncertainty, Bitcoin gives investors an alternative while real solutions rely on better policies and reforms.

Also Read: Government Shutdown Delays ETFs, Crypto Market Rallies